The only thing I enjoy less than paying bills is getting slapped with a late fee for accidentally paying bills after the due date. That’s why when Becky B. reached out on the blog and asked about bill paying apps, I jumped at the chance to test a few.

Becky B. wrote:

“I have looked into both apps to use for bill pay and a more complete up to the moment finance tool to help keep track of what’s available to spend in my checking. I think Prism is more accurate but charges a $2 a mo fee to pay bills. I wonder if you have ever or would compare the two apps? Thx!”

Thank YOU Becky— I tested a bunch of bill paying apps, and identified two— Mint and Prism — to determine which was best at keeping me on top of my bills each month.

To quote Destiny’s Child, what I wanted from a bill-paying app was simple: “Can you pay my bills?” Yet, some made it harder than it had to be. Read on to see which app I’m going to ride or die with.

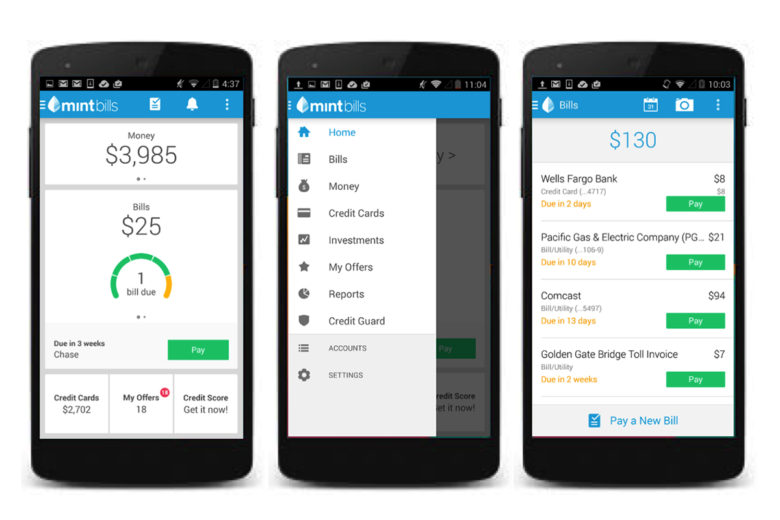

Mint: Personal Finance, Budget, Bills & Money

The Pros. The widely known personal finance app added bill tracking and payment features late last year. Like other apps in the category, it streamlines the bill-paying process by allowing you to organize all your bills in one centralized location and then review, manage and pay them from your phone for free. It sends reminders when bills are due — so helpful! — and checks to make sure you have enough money in your account to cover your bills. Plus, the bill-paying features are just one of many services Mint offers to help you track your personal finance and work toward short- and long-term goals like sticking to a budget, saving money and increasing your credit score. But, on the other hand…

The Cons. Those multiple services can lead to information overload — sometimes I just want to pay a bill, not see it integrated into my overall spending habits. Also, I’ve noticed that the app is sometimes slow to update my account balances and bill payments. There isn’t a version for iPad — annoying when I want to pay bills from my tablet — although the company says that one is in the works.

Download iOS | Google Play

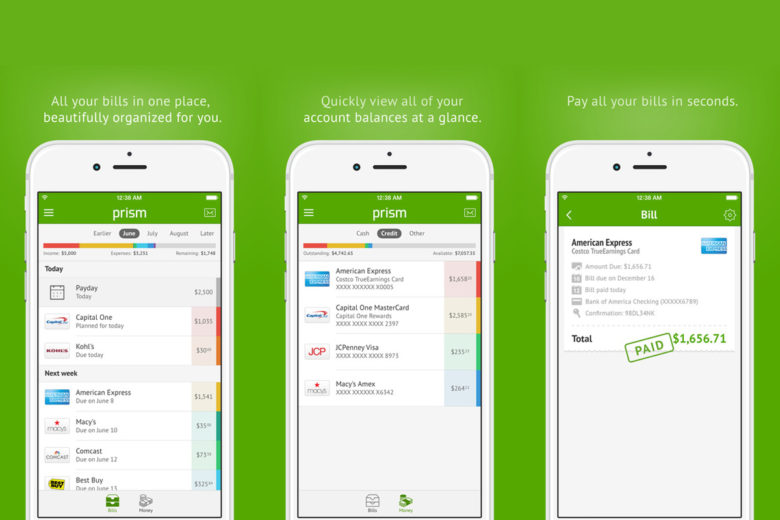

Prism Bills: Pay, Track, Organize & Remember Bills

The Pros. This app is super-straightforward and easy to use: Once you add your billers, you get reminders when your bills are due and pay them directly from the app. One of the major benefits of Prism is that the biller is paid directly — instead of through a bill pay service or third-party processor — which means you can make same-day or instantaneous payments. Definitely a perk if you’re a procrastinator! Oh, and the tech support is awesome: The response time is typically one business day, which is important when your money is involved.

The Cons. Compared to Mint, there’s no insight or analytics into your spending habits and overall financial situation. It pays your bills… and that’s pretty much it.

Download iOS | Google Play

The Verdict. When it comes to user experience and simplifying the bill paying process, Prism is the best choice. It’s simple, seamless and reliable — all things that I need from an app. If you want your financial app to do more than just pay bills, bills, bills, however, then Mint is a great alternative with tons of extra budgeting features.

Do you need a bill paying app? Do you use one now that you like? Let me know in the comments!